Start trade with CFD Trading System and get CFD online alerts.

CFDs are financial instrument that provide a way of entering various markets including stock market, without actually buying any shares or currencies etc.

Contracts for Difference have been traded by institutions in the market place for many years. During the last fifteen years the product has been increasingly available for individual investors.

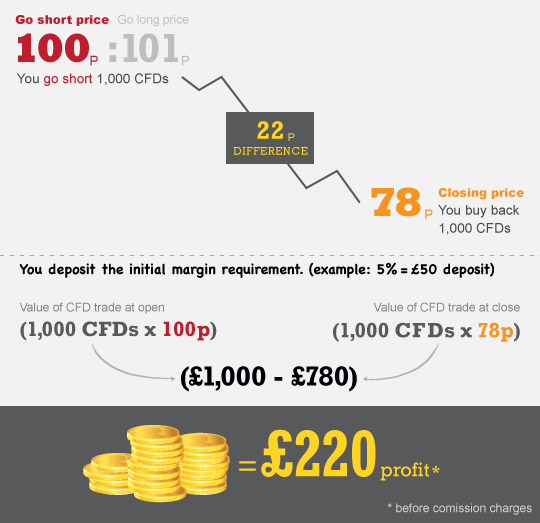

A Contract for Difference is a contract between two parties, typically described as 'buyer' and 'seller', stipulating that the seller will pay to the buyer the difference between the current value of an asset and its value at contract time. This is also described as CFD trading.

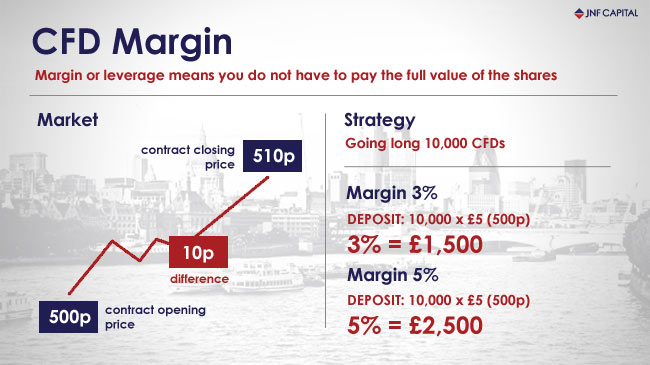

For example, if the value of a share is 500p at the opening of the contract and 510p at the close of the contract, then the difference is 10p. If the investor has bought 10 000 CFDs and predicts that the share price will rise, then their gross profit will be 10,000 x 10p = £1,000.

CFDs provide a way of entering the stock market without actually buying the underlying asset, for example without actually buying shares. Instead, the investor pays commission to enter the contract then pays interest on the remaining value of the underlying asset if held overnight. The interest continues until they decide to end the contract.

Compared to traditional share buying, CFDs trading offer the possibility of a higher profit for a smaller investment. On the other hand, losses as well as profits can be magnified.

"Margin" is one of the most important aspects of CFD trading. Margin or leverage means you do not have to pay the full value of the shares. Instead, you put down a deposit. For example, the 'initial margin' for a share would usually be 3% or above (Margins are subject to change).

When trading currencies and indices using CFDs, the margin rates are as low as 0.25%. Margin trading allows you to magnify your position in the market. Compared to buying shares, spending the same amount of money on CFDs provides the opportunity to magnify your profit. Remember, however, that leverage also magnifies losses. Read full manual how cfd trading works. About 5 articles explains different aspects cfd trading with more examples.